VA Tax Credits

Join the program!

Get started on your 2025 plans to leverage the tax credit program to benefit students!

Would you like to triple your impact?

- A contribution of $28,500 results in a $18,500 VA state tax credit, for a total out of pocket to you of $10,000! The program allows you to triple your impact!

- A contribution of $2,850 results in $1,850 for a total out of pocket to you of $1,000!

What is the tax credit program?

If you pay Virginia state taxes, you can complete some simple paperwork to have your gifts triple in value and support students!

The Virginia Education Improvement Scholarships Tax Credit Program makes this possible. The program provides state tax credits of 65% of their donations to contributors who give for accredited private schools.

This year, EMS has 68 students who are each eligible for financial aid awards of up to about $8,096 (through tax credit support).

Please help students gain access to financial aid of more than $460,000 through the tax credit program by considering a contribution for EMS. Credits are available on a first come, first served basis.

How it works - 3 easy steps

- Complete the Preauthorization Form and mail to:

VA Tax Credit Program

The Community Foundation of Harrisonburg- Rockingham

P.O. Box 1068, Harrisonburg, VA 22803. - Contribute through the Community Foundation within 180 days, (after you've received the tax credit approval) including a separate note with your preference to support eligible EMS students. Please note that their offices are closed December 30-31.

- Claim your Virginia tax credit when completing your tax returns (you will receive a tax credit certificate from the dept. of education).

Let us know of your participation so we can track the available credits and say thank you!

Questions?

Please contact Paul Leaman at 540-236-6012 or Trisha Blosser at 540-236-6024.

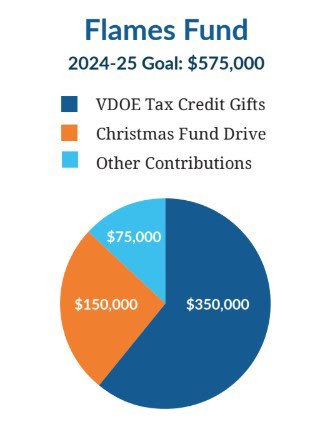

Your gifts at work through the FLAMES FUND!

*Contributions through this program help us reach our Flames Fund goal of $575,00 for 2024-2025. These contributions fund the lion's share of this goal and we strive for tax credit contributions of $350,000 (or more!) this year to fund financial aid for students.

Why I give through the program....

"The tax credit program has allowed us to give considerably more than we could have otherwise!

For us, we’ve contributed toward the end of the year, around October or November, and we don’t receive the credit until we do our taxes. That delay between the contribution and credit is important to keep in mind. Even so, our “out of pocket” result has been about a quarter of what EMS receives, so it has been a great way to bless the school and maximize our giving."

- Current parent

"When we realized we would be able to triple our giving from last year through the program, to me it was a no-brainer! Our contribution will have a more significant impact for the school and the same effect for us out of pocket."

Donor

Contributions support EMS learning experiences!

Marking the International Day of Peace on September 21, today was the 19th Annual EMES Peace Parade. The theme chosen by 5th grade student leaders was, Sweet People Are Everywhere! In recent weeks, each EMES class has delved into this special story by Alice Walker. Students shared what they have been learning: individuals around the…